Phase 1 Whistler properties – Things to know!

If you have been looking into Whistler property you may have heard the term ‘phase 1’ thrown around a bit, and although it’s usage as a definition in everyday conversation holds true for the most part, there are some nuances to it that are not known to the untrained eye!

So what does the term Phase 1 actually mean?

Phase 1 is a type of restrictive covenant that is placed on title to the property that runs with the property, and allows the owner to engage in short term (nightly) rentals, long term rentals or full time owner usage. There are about 5 types of ‘phase 1’ covenants in Whistler.

Sounds like the best ownership option then right?!

So in theory you can buy a property with a phase 1 covenant in Whistler and rent it out to tourists via AirBnB or some other medium, and make some money! Score!

But hold on just a second…

Not all properties that have one of the 5 variants of this covenant allow complete flexibility for owners in terms of how they rent it out.

This is due to some properties having a governing rental management agreement.

Although an owner can still technically rent their property out on a short term basis, these management agreements dictate the mechanism in which that can occur.

So which complexes have a management agreement?

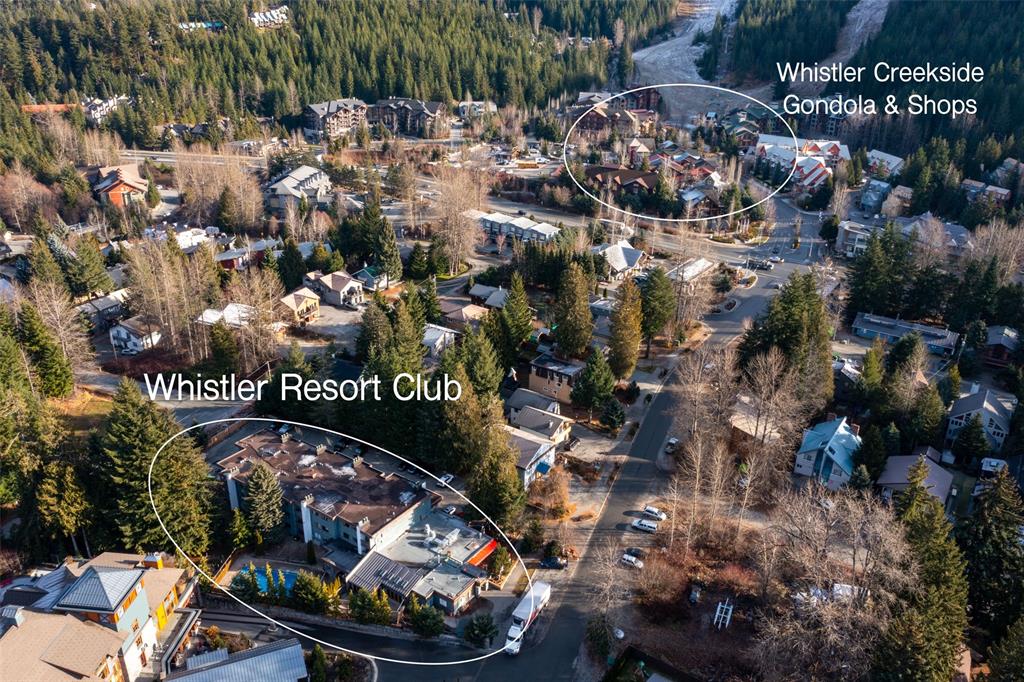

Located in the upper village at the base of Blackcomb Mountain mere steps from the new Blackcomb Gondola, the location of Le Chamois is hard to beat. If you want to rent it out however, their bylaws stipulate that you sign on to their management agreement. Some owners risk not signing it!

Located in the village near the Whistler gondola, the Whistler Hilton hotel although a phase 1, only allows rentals through their services and owner usage comes at a cost!

Located in the benchlands, Lost Lake Lodge is a great complex, in a nice location, but if you want to rent it out, it has to be done through the front desk via Whistler Premier.

Located near Whistler golf course and the Westin hotel, the Tantalus, although designated ‘phase 1’ allowing nightly rentals, can only operate nightly rentals using the on site management company. Units can be pulled from the rental pool for purely personal or long term tenant use providing that sufficient units exist in the rental pool, and for a sizeable cost… approximately $1300/mo. When you rent the unit using the on site management, this monthly fee is paid for out of revenues.

So what sort of things should you be thinking about with Phase 1 properties?

- Financing – yes these can be financed. Depending on your usage (personal or rental) you will likely be offered a different rate. Most lenders aren’t fond of ‘nightly rentals’.

- Revenues – what ranges can you expect for a 1,2,3+ bedroom unit? The average gross revenue you should expect for a decent 1 bedroom is approximately $65,000/yr. 2 bed is more like $95,000/yr, but then you jump up for 3 and 4’s, with a decent 3 bedroom (renovated, prime location) generating in the region of $140,000/yr. These are generalizations and obviously every property and its performance vary.

- Rental Management – what are your options? Well that depends how ‘hands on’ you want to be. But Whistler has a vast array of management options, some starting from around $2000/yr plus commissions and cleaning and services, to full serviced management where they take 30% of gross revenues. Most absentee owners choose the upper level companies that charge between 25-30% for a hands off, professional experience.

- Investment – are you looking for cash flow, equity growth or personal (you want to spend more time enjoying Whistler and using your property). As a general rule of thumb I like to tell my clients that most properties in this sector struggle to cover costs unless you’re putting down at least 50%. This might obviously vary depending on the interest rate you can obtain and a number of other factors. But lets say you’re looking at a $2MIL property and you have $1MIL to put down, leaving a $1MIL mortgage. With a 5% interest rate, that’s around $6000/mo in mortgage repayments alone. That means that just for the mortgage repayment you’d need to NET $72,000 a year in revenue. This is why I like to work backwards with my clients. I.e. how much capital are you looking to inject into the investment, and therefore what are your options based on your investment preference.

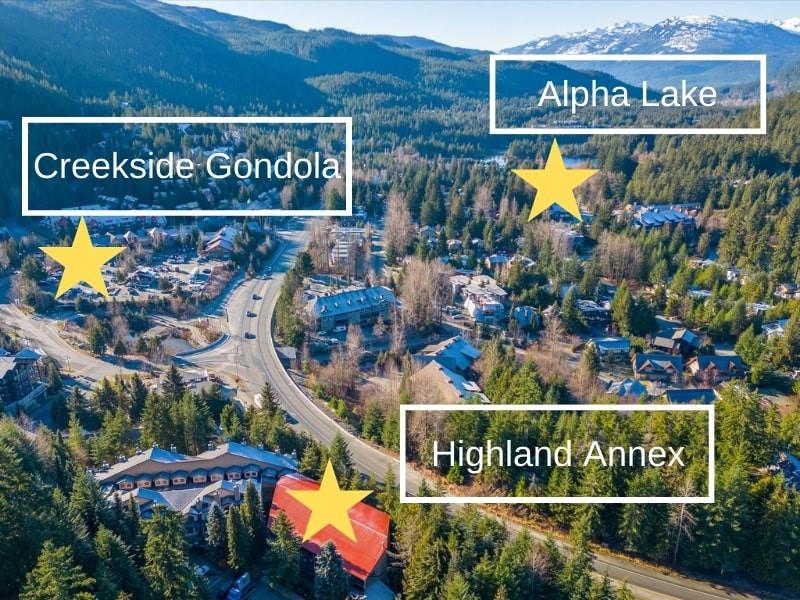

- Location – where is better for rentals? Winter time brings the highest rental rates and therefore areas close to the ski hill will fare better than others. However, units in and around the village may provide better consistency throughout the year so you don’t ebb and flow as much. You’ll also pay a premium in terms of purchase price to be in a prime location, so at what point does it actually make sense to purchase a lesser property (location) and take the rental ‘hit’, which may still work out favourably as you’ve saved on the purchase price. These are all the things we need to discuss.

- Amenities – on average, people prefer to have hot tub access when on vacation. It would pay to have one if you can. Some don’t like them, but if your goal is rental revenue then choose somewhere with one. Pools, not everyone cares about a pool, especially in winter, so these are less important than the hot tub, but I do have a post explaining exactly where you can find swimming pools in Whistler. What about things like storage lockers, or private garages.. is this for personal use or investment? You won’t find too many private garages near the ski hill unless you’re paying mega bucks so you need to think carefully on what’s important.

- Insurance – so many people that operate a nightly rental business do so without proper insurance. a standard home policy does not cover the commercial operation you are doing. A short term rental policy can sometimes be an add on to your existing policy, with certain providers.

- Business License – The Resort Municipality Of Whistler requires all short term rental operators to have a business license, which is a cost of approximately $165/year.

Get your list of Phase 1 properties by using the contact form below