A strata depreciation report is an essential document for potential buyers of properties within a strata or condominium complex. It provides valuable insights into the condition of the building and the expected maintenance and repair costs over time. Here are 10 important things a buyer should know about a strata depreciation report:

- Purpose and Importance: A strata depreciation report outlines the anticipated future repair and replacement costs for common property elements within a strata corporation. It helps buyers understand the financial health of the strata corporation and potential costs they might be responsible for in the future.

- Contents: The report typically includes a detailed inventory of common property components (e.g., roofing, plumbing, elevators, building envelope) along with their estimated remaining lifespans and projected costs for repair or replacement.

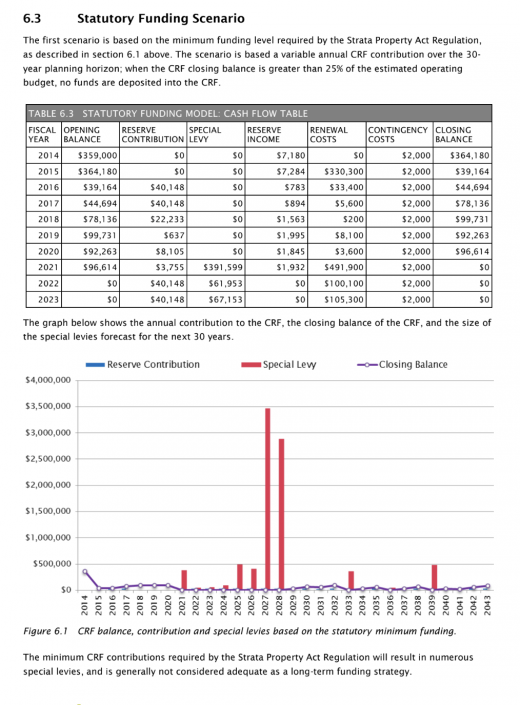

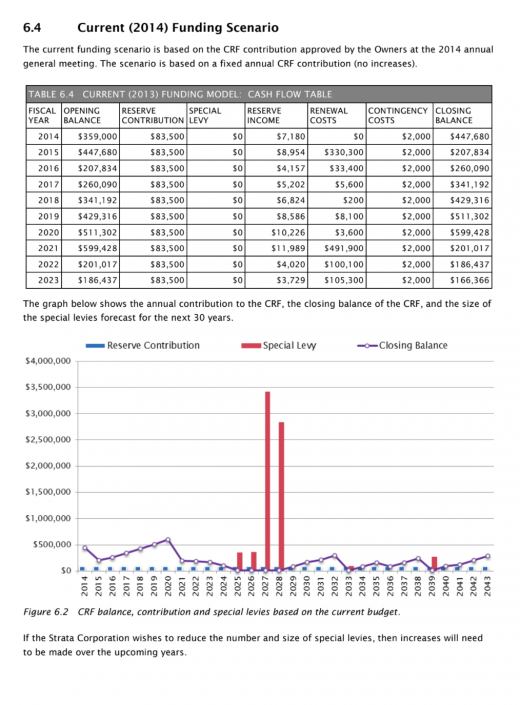

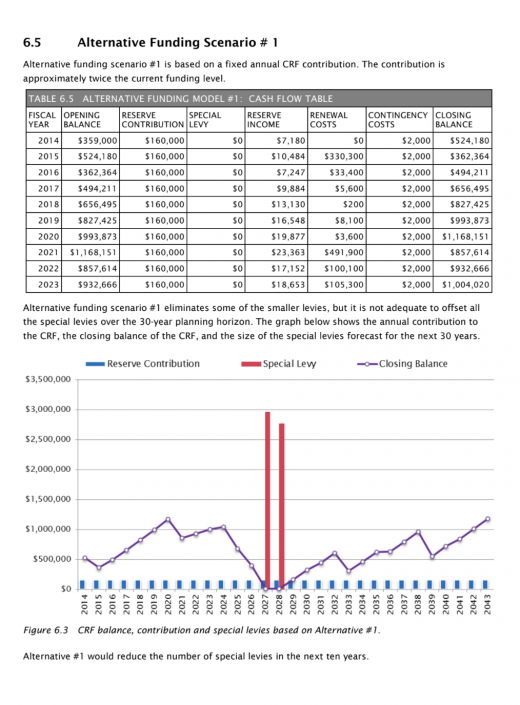

- Maintenance Planning: The report provides a long-term maintenance plan that helps the strata corporation manage and allocate funds for necessary repairs and replacements. It gives buyers an idea of the strata’s financial preparedness for future maintenance.

- Reserve Fund: The report often includes an assessment of the strata corporation’s reserve fund, which is a savings account set aside for future maintenance and repair expenses. A well-funded reserve fund is a positive sign for potential buyers.

- Financial Implications: Buyers can use the information in the report to evaluate the financial health of the strata corporation and anticipate potential increases in strata fees or special assessments to cover maintenance costs.

- Transparency: A comprehensive report promotes transparency and helps buyers make informed decisions about their purchase. It allows buyers to assess the overall condition of the building and understand the potential costs they might incur.

- Professional Expertise: Strata depreciation reports are usually prepared by professional consultants who specialize in building assessments and financial planning. Buyers can have confidence in the accuracy and reliability of the information presented.

- Assessment Schedule: The report typically includes a schedule for re-assessing the building’s components and updating the projected costs. This ensures that the strata corporation has an ongoing plan for addressing maintenance needs.

- Legal Requirements: In many jurisdictions, strata corporations are legally required to obtain and update depreciation reports at specific intervals. Buyers should verify if there are any legal obligations in their region.

- Due Diligence: Reading and understanding the strata depreciation report is a critical part of a buyer’s due diligence process. It helps buyers make an informed decision about purchasing a property by assessing the potential long-term financial implications.

Remember that a strata depreciation report is just one aspect of evaluating a property. It’s important to also consider factors such as location, amenities, building management, and other relevant information before making a decision. Consulting with real estate professionals and legal experts can help ensure a thorough assessment of the property’s suitability for your needs and financial situation.

How do I help you with this?

- Explanation and Interpretation: I am familiar with the terminology and content of depreciation reports. I can explain the key components of the report to a buyer, such as the inventory of common property elements, projected repair and replacement costs, and reserve fund status.

- Contextualization: I can provide context by comparing the information in the report to other properties in the market or within the same complex. I can help buyers understand whether the projected costs and reserve fund levels are within the typical range for similar properties.

- Financial Analysis: I can help buyers assess the potential financial implications of the information in the report. This could involve estimating potential increases in strata fees or special assessments and helping the buyer evaluate if these costs fit within their budget.

- Negotiation: If the depreciation report reveals significant upcoming repair costs or funding shortfalls, I can assist buyers in negotiations with the seller. It may help to negotiate for a reduction in the property’s price or ask the seller to address certain maintenance issues before completing the purchase.

- Guidance on Decision-Making: A depreciation report is just one piece of information in the buying process. I can guide you in considering the overall picture, taking into account factors like location, property condition, amenities, and potential future costs.

- Recommendations for Experts: If certain aspects of the report require further clarification or if you, the buyer have specific concerns, I can recommend experts such as property inspectors, engineers, or legal professionals who can provide more in-depth analysis.

- Navigating Legal Aspects: I am familiar with local regulations and laws related to strata properties. I can help buyers understand any legal obligations or requirements related to the depreciation report in their jurisdiction.

- Access to Resources: I have access to industry resources, databases, and networks that can provide additional information about the property, its history, and its strata corporation.

- Time Management: Reviewing and understanding a depreciation report can be time-consuming. I help can manage the process on behalf of the you the Buyer, ensuring that deadlines are met and the necessary due diligence is performed.

Ensuring Informed Decision-Making: Ultimately, the role of me as your real estate agent is to help you make an informed decision. By providing insights into the report’s implications and helping the you understand how it fits into your larger buying strategy, I contribute to a well-rounded decision-making process.