“You can make tons of money from buying a property in Whistler and renting it on AirBnB!” …. This seems to be a common thing I hear, so is it true?

Well, yes and no.

You can certainly earn some great revenue with a Whistler airbnb property. But its pay to play i’m afraid.

I tell my clients that you typically need around 50% (or in many cases even more) downpayment in order to cover costs, if you require a management company to handle the operation of the rental. Those who can handle that personally can either do even better with their returns, or require less downpayment to enter the market.

It also greatly depends on how you view your investment.

For some, simply having a consistent place to use and call home when in Whistler, while covering some expenses with revenues is a great way at looking at their investment, and frankly a way that I’m a big advocate for.

Or, if you need to cover costs at the very least or even enter the realms of positive cash flow then you’ll need to delve into the numbers a lot more.

So, covering costs… how much do you need to put down?

Well, there are a huge number of variables which will impact this question, but if we take a very average approach to this, you might come up with the following:

- Assume an average 2 bedroom that can be rented nightly, this is approximately $1.7M right now.

- Average gross rental rates are approximately $80-90,000 per year.

- Most management companies charge 28-30% of gross revenue.

- That means that your adjusted gross revenue after management expense is more like $60-70,000/year.

- subtract your strata fees, property taxes and tourism Whistler fees, which on average total approximately $15,000/year based on the sales stats for 2 bedroom sales in the last 6 months, which gives you a net result of between $45-55,000/year, or $3750-4600/mo.

So, how much mortgage can you cover with $3750-4600/mo? Right now at the time of writing this, mortgage costs are approximately $615 for every $100,000 borrowed based on Dominion Lending figures for a 5 year fixed mortgage.

That means that you can cover approximately $600,000-750,000 worth of mortgage payments with your net revenue.

So, your $1.7M purchase, with up to $750,000 worth of mortgage covered with revenues means you’re looking at needed a downpayment close to $1million. Or approximately 60%.

Now imagine you don’t need management fees because you do it yourself… now you’re in the money! But for the majority of people that’s just not feasible.

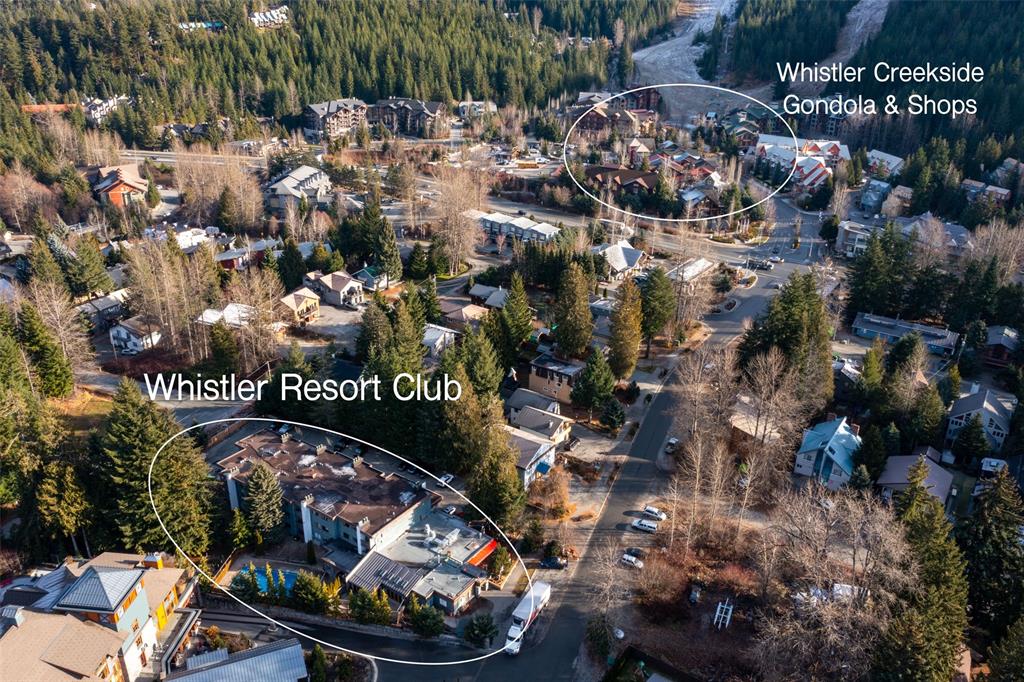

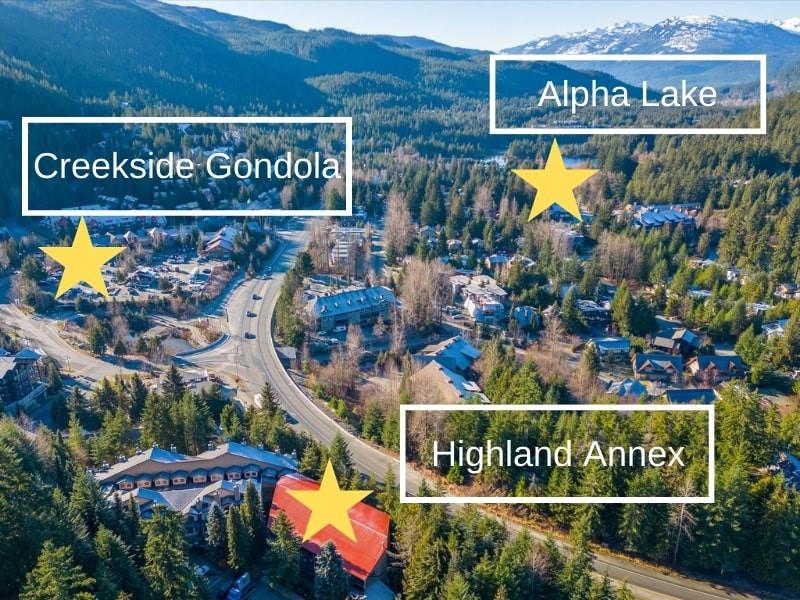

What about entry level stuff? Things like a Gondola Village unit?

These places are small, 400sq ft 1 bedroom units in Creekside and represent our most common entry level nightly rental product.

They currently sell between $750,000 (original, poor to average condition, poor location in complex) to $1million for renovated, good location, great condition units.

These places on average can generate upwards of $65,000/year. And if we do the analysis as above we get the following:

- $45k adjusted gross after 30% management.

- About $9k in strata fees, property taxes and tourism Whistler fees per year.

- So about $35+k in net revenue, or about $3000/mo average’d out.

- That enables approximately $480,000 worth of mortgage payment capacity based on the same $615/mo per $100,000 borrowed noted above.

- So for a good condition unit (which is what you would need to obtain those revenues) you’re going to need around 50% down.

So there you have it for entry level 1 bedrooms, and average 2 bedroom units. 50-60% downpayment needed to cover costs of mortgage, strata fee and tourism Whistler fees.

Obviously there are outliers to these analyses, and there are many factors to consider. I will say however that most management companies suggest it makes more sense financially to go for a 3 or 4 bed over a 2 bed unit. The rental options are greater and the properties themselves are rarer.

But what about the equity and appreciation side of the investment argument?

Covering all costs and even having positive cash flow are obviously nice things to have! But don’t forget about the basics too; building equity and gaining appreciation.

The benefit to building equity through a place in Whistler is that you have a place to use in WHISTLER! I mean come on… who doesn’t want that?? We’re also exempt from any current Foreign Buyer ban, we represent close to 25% of all tourism dollars in BC and Whistler is now on the map for the ultra Buyers; people who used to spend their millions elsewhere are coming here in hoards. That speaks fairly highly for future property values in my mind.

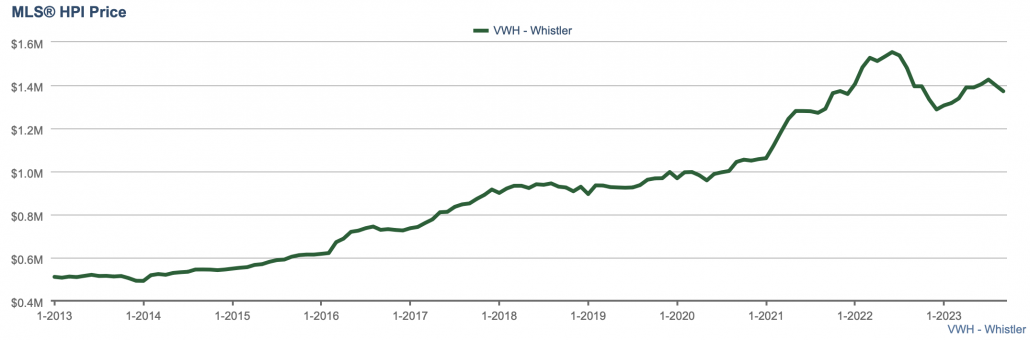

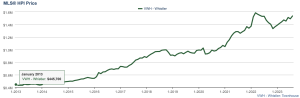

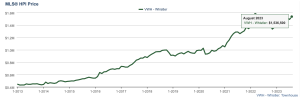

Whistler condos and townhomes have appreciated 245% since January 2013. WOW.

See Whistler condo and townhome listings below!